Money Mastery

Everything you need to get your finances in order.

The Team at Impruvu is extremely helpful, I ask so many questions and they never complain! When I was a builder, I trained many new guys and the most frustrating thing was when they asked a question that I had already gone over with them. But the team at impruvu is always there to answer my questions no matter how trivial they are or even if it was already touched on in the BB course!

Dustin

Business Owner

Learn to manage your finances the right way.

The Money Mastery course is an extensive program designed to educate participants on various aspects of personal and business finances, credit management, investment, and wealth accumulation.

The course aims to equip individuals with the tools and knowledge necessary to transform their financial understanding and effectively manage and grow their wealth.

Money Mastery offers a holistic approach to financial education, targeting both novices and those looking to refine their financial strategies to reach new heights in personal and business financial success.

We have one goal.

You, the client.

Learning Modules

A quick breakdown of everything you will learn.

Welcome Module

Sets the stage for the course and addresses any prerequisites needed for full participation.

Your Finances

Participants are guided through personal financial assessment, goal setting, and strategic financial planning.

Credit

An in-depth look at credit basics, including how to read and improve credit reports and achieve an ideal credit profile.

LIBOR, PRIME, EFFR & FED (FFR)

Explains important financial rates and concepts, emphasizing their role in personal and business finance.

Cleaning

Focuses on strategies to improve credit scores, such as reducing credit utilization, managing credit inquiries, and the timing of payments.

Foundations

Prepares participants for building strong financial and credit foundations.

Building

Teaches strategies for building credit through various financial products and maintaining good credit habits.

Business Credit

Comprehensive coverage on establishing and managing business credit, including legal and operational aspects of business setup.

Understanding Credit Cards

Insights from financial experts on maximizing credit card benefits and managing different types of credit accounts.

Scaling

Advanced strategies for scaling personal and business credit to higher levels.

Funding

Detailed guidance on acquiring funding, understanding bank rules, and navigating different lending options.

HELOC & HELOAN

Explores home equity products, advanced strategies like bureau stacking and term loan stacking, and techniques for securing optimal financing terms.

Manufacturing

Techniques for manufactured spending and cashflow to optimize credit usage and financial leverage.

Managing Debt

Best practices for managing and consolidating debt, including tools and strategies for effective debt management.

Turning Credit into Cashflow

Methods for leveraging credit to generate income and cash flow.

Wealth

Comprehensive investment education covering stock markets, major asset classes, diversification strategies, and setting up investment accounts.

Travel Hacking

Strategies for using credit and financial savvy to optimize travel experiences.

Aged Corps

Discusses the benefits and processes for acquiring aged corporations to enhance credit and business opportunities.

Taxes

Guidance on managing personal and business taxes, including tax preparation services.

Trusts

Explanation of trusts, their benefits, and the distinctions between different types of trusts.

Best Practices / Common Mistakes

Summarizes key lessons and common pitfalls to avoid for maintaining robust financial health.

Advanced and Additional Resources

Includes locked content likely covering advanced topics, special offers, and proprietary tools designed to enhance practical application of the course materials.

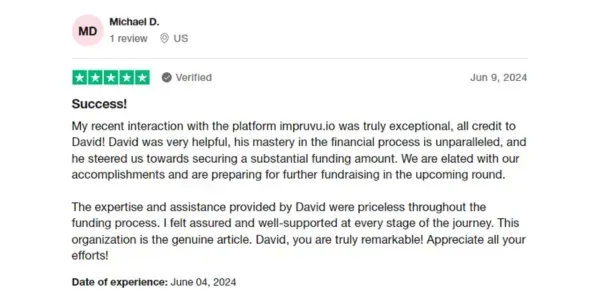

What Our Clients Say About Us

Team of professionals by your side from beginning to end.

The Impruvu Experience

Team of professionals by your side from beginning to end.

Enroll Today

Get instant access to Money Mastery!

Select your product below before proceeding to checkout.

I agree to the terms and conditions and privacy policy. Furthermore, I grant permission for Impruvu LLC to communicate through the contact details provided in this form. Reply STOP to unsubscribe from SMS at any time.