Unlock Your Business Potential with Flexible Funding Solutions

Get the capital you need from over 5,000 lending sources with quick approvals and personalized service.

Great news, your loan has been approved!

Something for everyone.

We believe in more than just providing funding; we believe in building relationships and supporting businesses through every step of their growth journey. Whether you're a startup, an SME, or a franchise owner, our dedicated team works closely with you to create funding solutions tailored to your unique needs. With access to over 5,000 lending sources and a streamlined application process, we ensure you receive the capital you need quickly and efficiently.

We provide tailored funding solutions for startups, SMEs, and franchise owners. With 5,000+ lending sources and a streamlined process, we ensure quick and efficient access to capital.

Why Choose Impruvu for Your Business Funding Needs?

Quick Approval: Get funding decisions in minutes.

High Approval Rates: Comprehensive evaluation criteria increase chances of approval.

Flexible Terms: Repayment options that fit any business's cash flow.

Competitive Rates: Low-interest rates to minimize costs.

Wide Range of Products: Access to over 5000 lending products tailored to your needs.

Dedicated Support: Our team is here to guide you through every step of the funding process, providing personalized advice and support.

What can you do with funding from Impruvu?

Enjoy the benefits of working directly with Impruvu, no matter your goal, our team will find the perfect funding solution for you

Expansion

Open new locations or expand existing ones.

Inventory Management

Purchase new inventory to meet demand.

Equipment Purchase

Buy or upgrade essential equipment.

Cash Flow Stabilization

Manage cash flow during slow seasons or unexpected expenses.

Operational Costs

Cover daily operational expenses to keep the business running smoothly.

Marketing and Advertising

Invest in marketing campaigns to grow your customer base.

Research and Development

Fund R&D projects to innovate and stay ahead of the competition.

At Impruvu, your trust and security are our top priorities, with thousands of clients and accreditation ensuring your information is protected and your experience is seamless.

Something for everyone.

Not sure what's best for you? Our team of professionals are ready to chat.

Business Line of Credit

Leverage a flexible revolving line of credit and only pay interest on what you use. Access funds at your own pace to meet your business needs as they arise.

0% Business Credit Stacking

Launch your business with confidence using multiple 0% interest accounts. Enjoy the convenience of accessible cash with revolving credit at a 0% interest rate.

Asset Based Lending

Unlock the hidden value of your company’s assets. Convert your inventory, equipment, or receivables into the funds you need to grow and sustain your business operations.

SBA Loans

Benefit from government-backed Small Business Administration loans offering lower interest rates and longer repayment terms. Ideal for expanding your business, purchasing real estate, or refinancing debt.

Bridge Loans

Navigate transitions with ease using short-term bridge loans. Cover immediate expenses or investments while waiting for long-term financing or other funding to come through.

Commercial Real Estate Loans

Invest in your business's future with financing for commercial property purchases or renovations. Secure competitive rates and terms tailored to your real estate needs.

Long Term Business Loans

Experience the stability of a traditional loan with the benefit of lower payments spread over an extended term, making it easier to manage your finances.

Short Term Business Loans

Access quick funds for urgent business expenses. This is your go-to solution for fast, convenient financing when timing is critical.

Personal Loans

Secure a personal loan with terms up to five years to manage credit card balances, enhance your credit score, and qualify for 0% business funding.

Simple & fast funding process.

Our streamlined process makes funding easy. Apply online and receive your funds smoothly so you can focus on achieving your goals.

Check Your Rate

Fill out our online application form with your details and funding needs. Our user-friendly platform ensures a hassle-free experience.

Choose Your Loan

We match you with the best lenders from our extensive network, ensuring the most favorable terms and rates tailored to your situation.

Receive Funds

Get approved and receive your funds quickly, often within 24 hours. Our efficient process ensures you have the capital you need when you need it.

Achieve Your Goals

Use the capital to meet your personal, business, or real estate goals and succeed. Our support doesn't end with funding; we’re here to help you every step of the way.

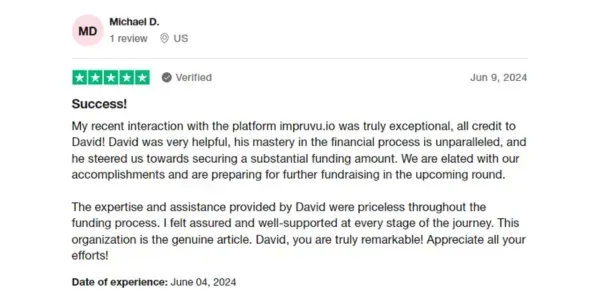

What Our Clients Say About Us

Team of professionals by your side from beginning to end.

Frequently Asked Questions

Our FAQ section is designed to answer your most pressing questions and provide clarity on our processes. If you need more information, our team is always here to help.

How long does it take to get a loan approved?

Loan approval times can vary depending on the type of loan, the completeness of your application, and other factors. Generally, you can expect a decision within 1-5 business days after we receive all necessary documentation.

What documents do I need to provide?

Usually, you’ll need proof of identity, proof of income, and financial statements. Depending on the type of loan, other documentation may be required. Your advisor can discuss this further with you.

I don't have a business, can I still get funding?

Yes. We will walk you through how to properly setup a business, and then begin the business funding process.

Can I secure funding with just an EIN?

Yes, but to secure higher limits and 0% interest terms, you will need to have a solid credit profile, 680+ to start.