Meet Impruvu

We're optimizing the funding space.

5,000+

Lending Products For

Businesses and Individuals

Financial solutions you can bank on.

"Impruvu has been there to help me start my business and continue growing it years later."

Why is Impruvu A Step Above The Rest?

Largest Lending Network

With over 5,000 lending sources, we can secure the best terms and rates for your funding needs, providing you with more options and better deals. Our extensive network allows us to find the perfect match for your financial situation, whether personal, business, or real estate.

Professionalism is Everything

We ensure loans are accessible to a broader audience, including those with less-than-perfect credit scores. Our inclusive approach helps more people achieve their financial goals.

Innovating Fintech

Our proprietary funding technology assesses and approves loans quickly and accurately, leveraging data to provide you with the best possible funding options.

We have one focus.

You, the client.

Ready to take the next step? Discover the funding solutions that best meet your needs. Our team is here to help you navigate your options and secure the capital required to achieve your goals.

No pressure.

No friction.

Just funding.

Securing the funds you need is effortless with Impruvu. Experience a streamlined process that eliminates stress and hassle, ensuring financial support without any pressure or friction. Enjoy a smooth, seamless journey from start to finish, with a team dedicated to making your funding experience as easy and efficient as possible.

Get to know us.

A message from our team.

At Impruvu, your financial needs are our priority. Your tailored lending solution is crafted to fit your unique situation, offering the most flexible and competitive options available. From application to approval, you can expect a stress-free and efficient process backed by our proven success with over $80 million in loans delivered.

By choosing Impruvu, you're partnering with the trailblazers who have set the industry standard. You will benefit from our smooth, reliable, and superior funding experience, guided by our unwavering professionalism and commitment to your success.

Your financial journey with us is supported by our continuous adaptation, optimization, and innovation. This dynamic approach ensures you receive cutting-edge financial services that help you achieve your goals efficiently.

Thank you for trusting us. We are excited to be part of your financial success story.

We look forward to meeting you,

Damon Aleczander

CEO

Interested in funding

your clients?

Frequently Asked Questions

Our FAQ section is designed to answer your most pressing questions and provide clarity on our processes. If you need more information, our team is always here to help.

How long does it take to get a loan approved?

Loan approval times can vary depending on the type of loan, the completeness of your application, and other factors. Generally, you can expect a decision within 1-5 business days after we receive all necessary documentation.

What documents do I need to provide?

Usually, you’ll need proof of identity, proof of income, and financial statements. Depending on the type of loan, other documentation may be required. Your advisor can discuss this further with you.

I don't have a business, can I still get funding?

Yes. We will walk you through how to properly setup a business, and then begin the business funding process.

Can I secure funding with just an EIN?

Yes, but to secure higher limits and 0% interest terms, you will need to have a solid credit profile, 680+ to start.

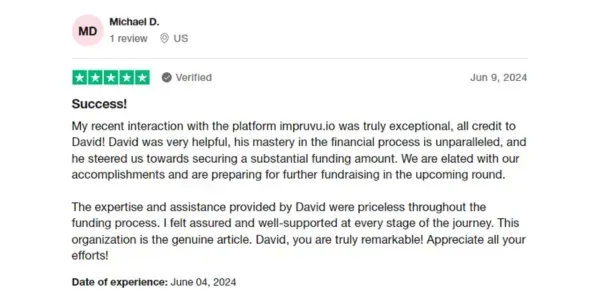

What Our Clients Say About Us

Team of professionals by your side from beginning to end.