LendBox Program

Start your own funding business, we take care of your clients.

Impruvu was a lifesaver when I needed to consolidate my student loans and high-interest credit card debt. Their quick approval process and competitive rates helped me lower my monthly payments significantly. With their personalized advice, I was able to improve my credit score and achieve financial stability. I highly recommend Impruvu to anyone looking to get their finances back on track.

Emily R.

Young Professional

Your bring the clients, we bring the funding.

The LendBox Partner Program is a strategic collaboration designed to leverage Impruvu's expertise in business and funding consulting.

It is particularly structured for partners who wish to outsource the fulfillment aspects of funding consulting to Impruvu, while still capitalizing on their client base.

In return for referring clients to Impruvu, partners receive a significant portion of the revenue generated from funding fees invoiced to successfully funded clients.

We have one goal.

You, the client.

Program Overview

A quick breakdown of program assets.

The LendBox Partner Program is designed to be an attractive option for businesses looking to expand their offerings in the funding consultancy arena without the overhead associated with fulfilling these services. Partners benefit from Impruvu's robust infrastructure and industry expertise, gaining a competitive edge while ensuring client satisfaction. This partnership not only enhances the partner's service capability but also offers a lucrative revenue-sharing model, making it a compelling business proposition.

Impruvu's IP Guarded Business Model

Orientation and community integration are emphasized to prepare learners for the journey ahead.

Automated Funding Consulting Agency

Focuses on setting personal goals, fostering motivation, and important preliminary housekeeping.

Company Website

An introduction to the lending industry, the role of a broker, and the benefits of becoming one.

LLC Structuring Guidance and Merchant Account Assistance

Comprehensive guidance on establishing a business, from creating logos and websites to setting up essential business tools like CRM and legal structures.

Trained Staff

Detailed exploration of credit concepts, credit reports, credit profiling, and practical steps for managing and optimizing credit.

Business Credit

In-depth look at business incorporation, the significance of business credit, and how to establish and utilize it effectively.

Partner Dashboard

Insights from financial experts on the advantages of various types of credit accounts and credit cards.

Marketing Materials, Lead Generation Options, and Advice

Covers the breadth of funding options available, including business loans, lines of credit, and venture capital, along with strategies for securing them.

Ongoing Operational Support

Detailed information on home equity lines of credit and loans, including how to utilize them effectively within the banking system.

Customization

Outlines the entire client process from assessment and qualification to securing funding and client management.

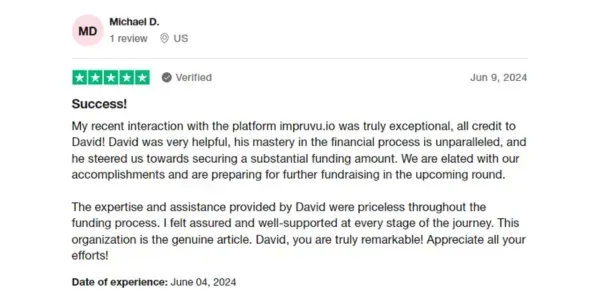

What Our Clients Say About Us

Team of professionals by your side from beginning to end.

The Impruvu Experience

Team of professionals by your side from beginning to end.

Get Started Today

Start your own funding business today!

Select your product below before proceeding to checkout.

I agree to the terms and conditions and privacy policy. Furthermore, I grant permission for Impruvu LLC to communicate through the contact details provided in this form. Reply STOP to unsubscribe from SMS at any time.